First Time Home Buyers

Are you ready to buy a home in Utah?

Go through this toggle to find out if you are ready to buy a home and receive some helpful tips!

What is your yearly income?

Your income is below average for a Utah home buyer. You may qualify for some C-class homes in Utah. You may need to find a way to increase your income if you want to live in a B Class neighborhood. I suggest talking with a lender to see their ideas and what you currently qualify for.

Your income is average for a Utah home buyer. There are a lot of homes in Utah that you will qualify for. You will mainly be qualified for B-Class homes in Utah. If you want to live in an A-class neighborhood you may need to increase your income.

Your income is above average for a Utah home buyer. There are a lot of A-Class homes in Utah that you will qualify for.

How long have you had your current job?

Lenders like to see employment history for 2 years to qualify someone to buy a home. You may not be in a great position because you have not had the same job for 2 years. However, some lenders may make exceptions if you can prove that your income is stable. I suggest chating with a lender about your job situation and ask their advise.

Lenders like to see employment history for 2 years to qualify someone to buy a home. You are in a great position because you have had the same job for 2 years. I suggest not switching jobs before buying a home because it could potentially slow down the process.

Have you met with a lender and got prequalified?

Congrats! If you are pre-qualified you are ready to buy a home and should have a good idea of your budget.

You will want to talk with a lender and fill out an application to get pre-qualified to buy a home. Lenders will look at your income, savings, job history, and credit score to determine what home price you will qualify for.

I suggest you come up with a game plan with your lender so you can get pre-qualified in the future.

How much money do you currently have saved up?

You may need to save more money to buy a home. You will need to put down 3-5% of the total purchase price of your new home.

You have a good amount of money saved up to buy a home. Because you are a first-time home buyer you will only need 3-5% down as long as you will be living in the house.

Utah Home Price Break Down by Area

How much money do you need to save up to buy a home in Utah?

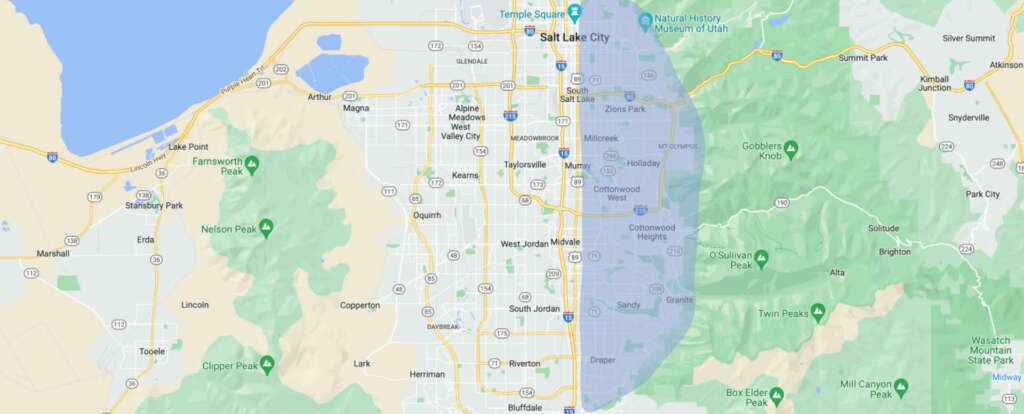

East Salt Lake Valley

This includes Sugar House, The Avenues, Cottonwood Heights, and Sandy neighborhoods. This area is the most expensive in Utah and you will need about $30K-$50K saved up to buy in these areas.

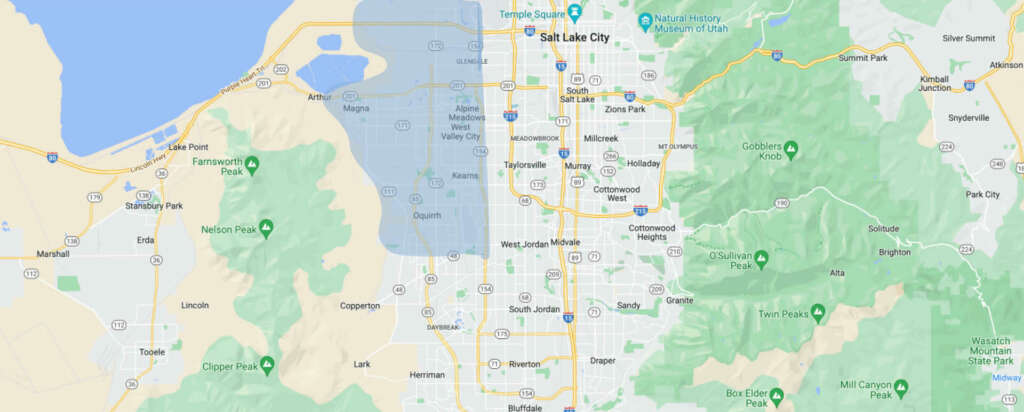

West Salt Lake Valley

This included cities like West Valley City, Magna, and West Salt Lake City. These areas are the least expensive in the Salt Lake Valley. You will need around $10k-$30k saved up to buy in these areas.

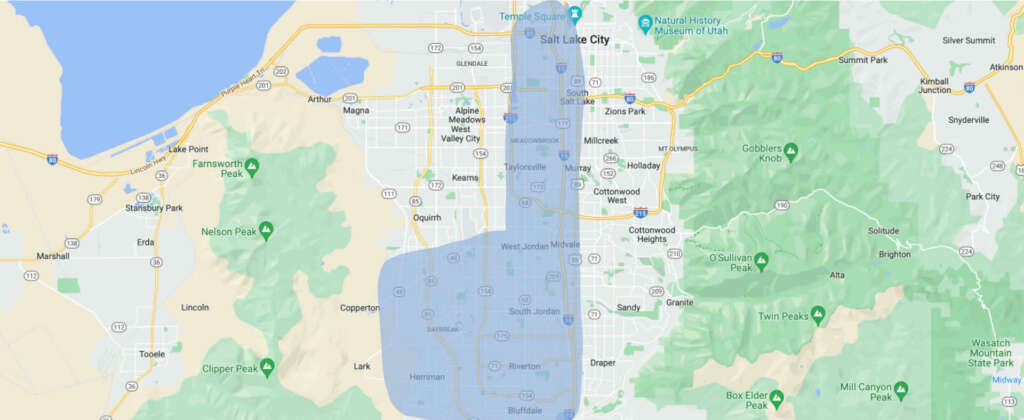

Central Salt Lake Valley

This area included cities like Midvale, West Jordan, Riverton, and Herriman. This area is a very nice area in Utah and you will need about $20k-$40k saved up for this area.

North Salt Lake to Layton

This area included cities such as Bountiful, North Salt Lake, and Layton. This area is comparable to central salt lake and you will need $20k-$40k saved up to buy a home in these areas.

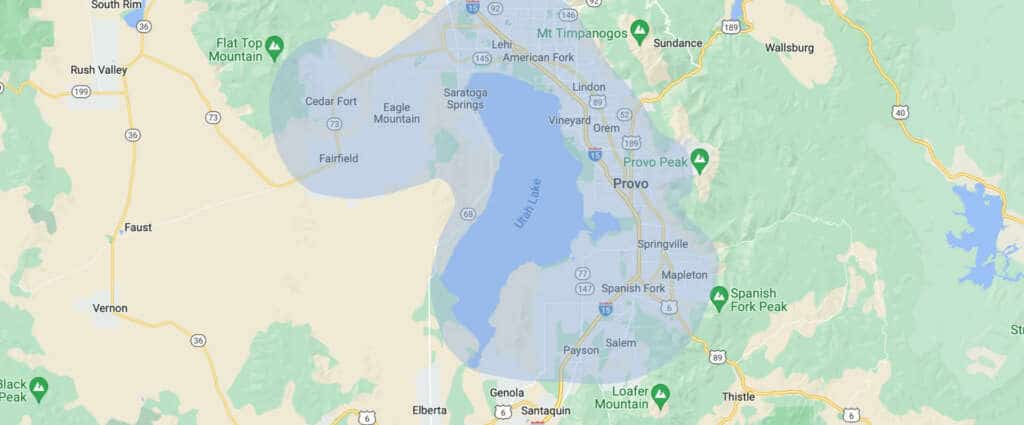

Utah County

Utah County included cities such as Provo, Eagle Mountain, and Pleasant Grove. There are some expensive areas in Utah County but there are also areas where housing is more affordable. You will need $10k-$50k saved up for this area.

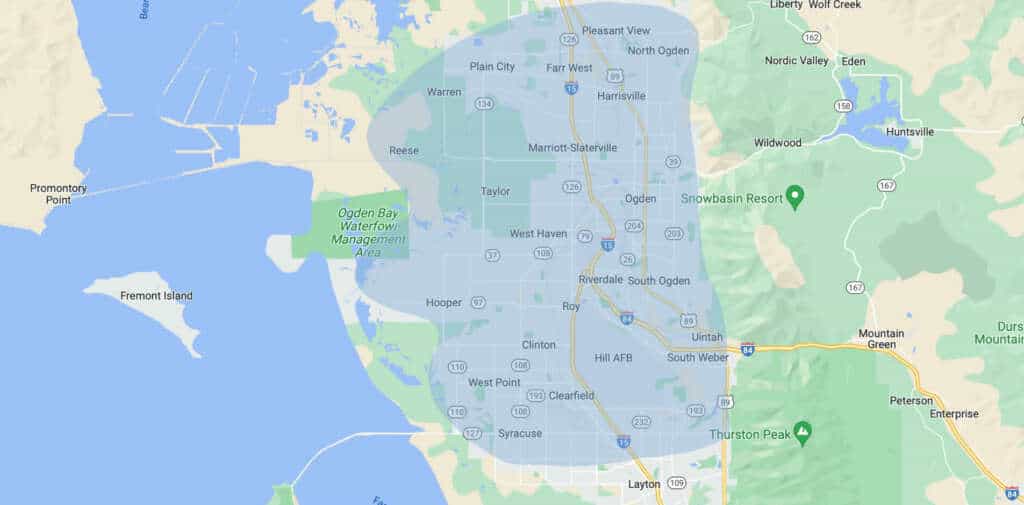

Ogden Area

This includes cities such as Ogden, Clearfield, and Clinton. There are really nice areas of Ogden but you can find affordable housing here. You should have $10k-$40k saved up to buy in the Ogden area.

Tooele County

This includes cities such as Tooele, Stansbury, Lake Point, and Granville. Tooele County is growing more each year and as it grows home prices slightly go up as well. To buy a home in Tooele you need $10k-$40k saved up.